Author: Dr. Nadia MANSOUR Summary: The object of our study is the banking interaction and financial stability. With financial liber...

Author: Dr. Nadia MANSOUR

Summary: The object of our study is the banking interaction and financial stability.

With financial liberalization, developing countries can’t stay safe from bank risks. However, few studies have focused on the study of the relationship between banking regulation in the Middle East and North Africa countries. Also, MENA countries have put in place different mechanisms to enforce prudential regulation to deal with the effects of financial crises with a banking system increasingly integrated with global financial markets. Nevertheless, the application of prudential regulation requires a lot of effort on the part of banks, which must have sophisticated means to measure bank risks, as well as the possession of the necessary capital to apply these standards.

1. GJRE: Global Journals Blog

From determinate relationship between financial stability and banking risks by taking into account the effect of prudential regulations in macro terms, in the context of Business Model in the conventional banks in MENA countries. Also, we have developed a relationship between the size of banks and financial stability. This relation represents the object of this study. The study would be based on three models to detect the relationship between Z-score and financial stability and the relationship between the level of capitalization and bank profitability and financial stability.

Business model analysis is essential for investors and supervisors. Previously, supervisors focused on capital, liquidity and risk management. However, the recent financial crisis has shown the value of analyzing the "Business Model" of banks. This model generally describes how banks generate their profits and what are their channels of transmission. It thus goes beyond traditional risk and banking income indicators, allowing supervisors a better understanding of the sustainability of bank profits and stability (Huang and Ratnovski 2011).

This situation brings us to the following questions: What is the relationship between bank risk and financial stability? What is the impact of prudential regulation on financial stability? The problem developed is the evaluation, firstly, of the relationship between banking risk and financial stability and, secondly, the impact of banking regulation on financial stability.

The results showed that banks with a poorly diversified income structure were significantly more likely to be distressed during a period of crisis and small banks will try to increase this margin to improve their stability. The cross-sectional regression over the entire sample shows that an increase in the volatility of banking income will increase the level of risk. To conclude, capitalization is the most determining factor in the Z-score variable at the banks of the MENA zone. This empirical analysis allows us to show that the major banks of the most economically developed countries are more stable. And for smaller banks, the significant volatility of revenues with a little diversified structure of these, make these banks less stable.

Figure 1: Countries in the MENA Region

(Source : worldbank)

2. SOURCE OF INSPIRATION

The period between 2003-2014 is rich in events in the MENA zone going from the Iraq war to The Arab Spring while going through the global financial crisis of 2009. However, few empirical studies have focused on this area although it has specific characteristics. First, these countries have bank-based financial systems, with bank assets accounting for 60% to around 100% of GDP in countries. This situation makes the banking system a key player in the financial intermediation process. Second, the considerable importance of banks in these economies makes bank credit the main channel of monetary transmission, Boughrara and, Ghazouani, (2011) and the lack of well-developed financial markets and the changing nature of money markets make the effectiveness of an interest rate channel much less attractive, Neaime, (2011). Third, even in financial terms, the banking sector's indicators of cost and performance conditions are similar: funding levels are adequate, revenue cost ratios are modest and, interest margins are high (World Bank, 2014 and IMF, 2015). Hence the motivation to work in the MENA zone.

We have a sample of banks for which we hold all the financial information necessary to conduct the empirical analysis. Our sample will include 146 conventional banks in 17 MENA countries (Algeria, Bahrain, Djibouti, Egypt, Jordan, Kuwait, Lebanon, Malta, Morocco, Oman, Palestine, Qatar, Saudi Arabia, Syria, United Arab Emirates, Tunisia and Yemen) over the period 2003-2014, which gives a panel of 1752 observations.

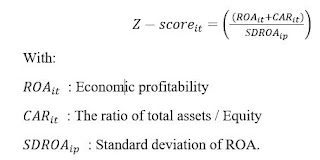

In this study, we will present "z-score" following the literature studies conducted by Stiroh (2004a, b), and Stiroh and Rumble (2006):

In this same context, and to get a better idea about the components of Z-score and their relationships with dangling dice variables, we use the following ratios:

(3)

To get a better idea about the relationship between Ln (Z-score) and its two components, we will draw the following two graphs:

Figure 2: Evolution of Ln (Z-score) and Ln (RAROA) in the MENA zone between 2003 and 2014

(Source: The author)

According to this graph, we can notice that the variable Ln (Z-score) progressed between 2003 and 2004 before falling from 2005 from 8.29731255 to 3.5212993. This peak was strongly correlated with the Iraq War, which began in 2002, and particularly affected the countries of the Middle East. Also, the risk of bank failure has experienced a second increase from 2009, which is related, on the one hand, with the subprime crisis and, on the other hand, with the geopolitical troubles in the MENA zone. Concerning the variable Ln (RAROA), it began to progress since 2009 following the same direction of evolution of Ln (Z-score).

Figure 3: Evolution of Ln (Z-score) and Ln (RACAR) in the in the MENA zone between 2003 and 2014

(Source: The author)

From this graph, we can notice that, apart from the peak of 2004, the variable Ln (RACAR) followed the same direction of evolution of Ln (Z-score). In fact, since 2005, both variables have achieved almost the same values. This result means that in recent years, the level of capitalization is stable in banks in the MENA zone.

The results of these study are the following:

*A high volatility of income in banks in the MENA zone. This situation calls for better monitoring of banks by financiers as well as better diversification of funding sources.

*The capital ratio variable is among the most important determinants of banks' financial stability in our sample. Any increase in this ratio will improve the level of solidity of the bank.

* Banks, whose net interest margin is higher, are also more stable and more profitable.

* By introducing the macroeconomic environment control variable "GDPGR" which reflects the growth rate by country, we noticed that it is positively related to "Ln RAROA." This result confirms Kohler's (2015) findings that banks in countries with higher levels of economic development are more profitable than other banks.

*A significant volatility of incomes in banks in the MENA zone. This situation requires a better monitoring of the level of capitalization of banks by the financial managers as well as a better diversification of the sources of financing.

3. How much time spent

This study is a part of my doctoral thesis. This is the last chapter and in which we have invested a lot because it is composed of 6 econometric models and a part of cross-section. I spent 5 years to finish my doctoral thesis and 3 months to complete and publish this article.

4. Ideas for future work

These studies can be extended by studying other samples and in particular the developing countries of South-east Asia, while integrating Islamic banks to make a comparison between conventional banks and Islamic banks in two geographically and economically different areas.

5. Publishing experience

The experience of publication was really interesting because the journal demanded different and strict control requirements before the edition.

Indeed, to strengthen my relationship with this prestigious journal, I am proud to become a “Fellow Membership of Global Journals”.

Figure 4: Front Page of Global Journal of Management and Business Research: Finance

6. Short Biography

Dr. NADIA MANSOUR is Lecturer Prof. at The Faculty of Economics and Management (Sousse). She holds a Ph.D. diploma degree in Management Sciences: « Banking regulation, efficiency and financial stability in banks: Case of MENA countries », from the Higher Institute of Management of Sousse, University of Sousse. Also, she has a Research Master in Finance and Banking from the Faculty of Law and Economics and Politics of Sousse and a Master in Higher Commercial Studies from the Institute of Higher Commercial Studies of Sousse. Her research interests focus on Banking, Prudential Regulation, Macro-economic, Business Tourism, Entrepreneurship and Innovation. She is also a member of Interdisciplinary Research Laboratory on Changes in Economies and Enterprises- Higher School of Economics and Trade-Tunis-Tunisia. Numerous papers and conference papers are published in regards to banking and finance with statistic modeling (Stata, Matlab, Dynamic Stochastic General Equilibrium…). She has published articles in international scientific journals as well as conference and book chapter (IGI Global) proceedings. She has presented various scientific papers in international (France, Morocco, USA…) and national conferences. In addition, her academic activities include participation in numerous research projects having different roles and responsibilities. Finally, she is currently, a Reviewer and a Fellow Member of the Global Journals, Academic Member and Ambassador at Communication Institute of Greece, Member at International Economics Development and Research Center, Leading Member and Reviewer on London Journals Press and Member at Young Scholars Initiative. Her courses are aimed at Student audiences in L1, L2, L3 and M2. Her career led her to teach many courses : Personal development, Management innovation, Entrepreneurship, Marketing, Management Principle, General Accounting, Preparation of financial statements, Financial Management II, Entrepreneurial strategy and Marketing innovation (Master 2 : Entrepreneurship), and as well as project Entrepreneurial management, In an international dimension in French and English.

Dr. Nadia MANSOUR

Research articles

- MANSOUR, N. and HADJSALEM, H., «Prudential regulation and stability banking in Tunisia: a DSGE Model», (June, 2019). Virtual presentation in « The Pan American Academic Summit », The City of Homestead, Florida, United States. Published in the site :

https://www.youtube.com/watch?v=-sFOB585VF0&t=5s

- MANSOUR, N and ZOUARI, E., « Interaction risk banking and financial stability: MENA countries», (2019). Global Journal of Management and Business Research: Finance, Vol. XVIII, Version I, Issue: 8, PP: 11-24.

- MANSOUR, N and ZOUARI, E., «Prudential regulation and banking efficiency in MENA countries», (2018). Global Journal of Management and Business Research: Finance, Vol. XVIII, Version: I, Issue: 7, PP: 53-72.

- MANSOUR, N and ZOUARI, E., « Prudential regulation and banking risk in MENA countries», (2018). Global Journal of Management and Business Research: Finance, Vol. XVIII, Version: I, Issue: 7, PP: 1-18.

Awarded as « Global Journals Best Paper Award »

- MANSOUR, N and ZOUARI, E., « Impact de la réglementation prudentielle sur le risque de faillite bancaire dans les Pays MENA », (2012). Published in the site :

http://www.asectu.org/forum-annuel/forum2013

Published by Global Journals

-https://globaljournals.org/GJMBR_Volume18/2-Banking-Interaction-and-Financial.pdf

-https://globaljournals.org/GJMBR_Volume18/1-Prudential-Regulation-and-Banking.pdf

-https://journalofbusiness.org › index.php › GJMBR › article › download